Stock Information

Corporate Stock Summary

- Stock listings

- Tokyo Stock Exchange, Standard Market

- Securities code

- 7716

- Number of shares issued

- 93,418,200 shares

- Number of shares per unit

- 100 shares

- Fiscal year end

- Dec. 31

- Annual general meeting of shareholders

- March

- Shareholder registration date

- Record date for the exercise of voting rights at the annual general meeting of shareholders: December 31

Record date for year-end dividends: December 31

Record date for interim dividends: June 30

- Stock transfer agent

- Sumitomo Mitsui Trust Bank, Limited

- Managing underwriter

- Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

Nomura Securities Co., Ltd.

SMBC Nikko Securities Inc.

Daiwa Securities Co. Ltd.

Mizuho Securities Co., Ltd.

UBS Securities Japan Co., Ltd.

- Main banks

- Ashikaga Bank, Ltd.

Mizuho Bank, Ltd.

MUFG Bank, Ltd.

Sumitomo Mitsui Banking Corporation

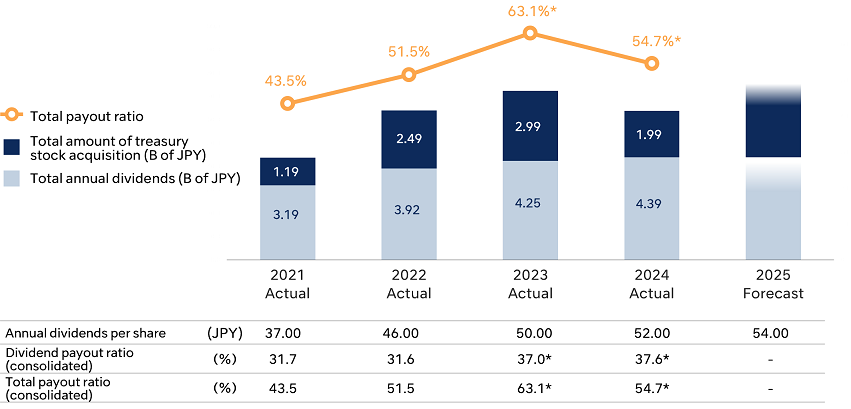

■Shareholder returns

- Dividends

-

We have adopted a progressive dividend policy, under which once dividends are increased, they are, in principle, not reduced.

We aim to further increase dividends to the extent possible to deliver consistent and stable shareholder returns.

- Total payout ratio

- We endeavor to perform the flexible acquisition of treasury stock, setting the standard for medium-term profit return as a total payout ratio of 70%.

■Transition of shareholder return

- In calculating the total payout ratio and dividend payout ratio for FY2023, the gain on step acquisitions from the full acquisition of DCI has been excluded.

- In calculating the total payout ratio and dividend payout ratio for FY2024, the profit decrease brought by the impairment loss of Jaeger has been excluded.

■Shareholder benefit program

There is no shareholder benefit program.

Stock Indicators

| FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | |

|---|---|---|---|---|---|

|

Total Shareholder Return (Comparison indicator: TOPIX) % |

110.2 (104.8) |

104.9 (115.7) |

128.2 (109.9) |

121.7 (137.5) |

125.3 (161.8) |

Principal of Shareholders (Top10)As of June 30, 2025

| Shareholder | umber of shares held(Thousand) | Shareholding ratio(%) |

|---|---|---|

| Custody Bank of Japan, Ltd. (Trust accounts) | 4,670 | 5.6 |

| Nakanishi E&N Inc. | 4,530 | 5.4 |

| Chiyo Nakanishi | 4,362 | 5.2 |

| The NSK Nakanishi Foundation | 3,721 | 4.5 |

| STATE STREET BANK AND TRUST COMPANY 505001 | 3,236 | 3.9 |

| Office Nakanishi Inc. | 3,120 | 3.7 |

| Eiichi Nakanishi | 2,802 | 3.4 |

| Kensuke Nakanishi | 2,798 | 3.4 |

| The Master Trust Bank of Japan, Ltd. (Trust accounts) | 2,688 | 3.2 |

| Ashikaga Bank, Ltd. | 2,265 | 2.7 |

| JP MORGAN CHASE BANK 385632 | 2,244 | 2.7 |

|

||

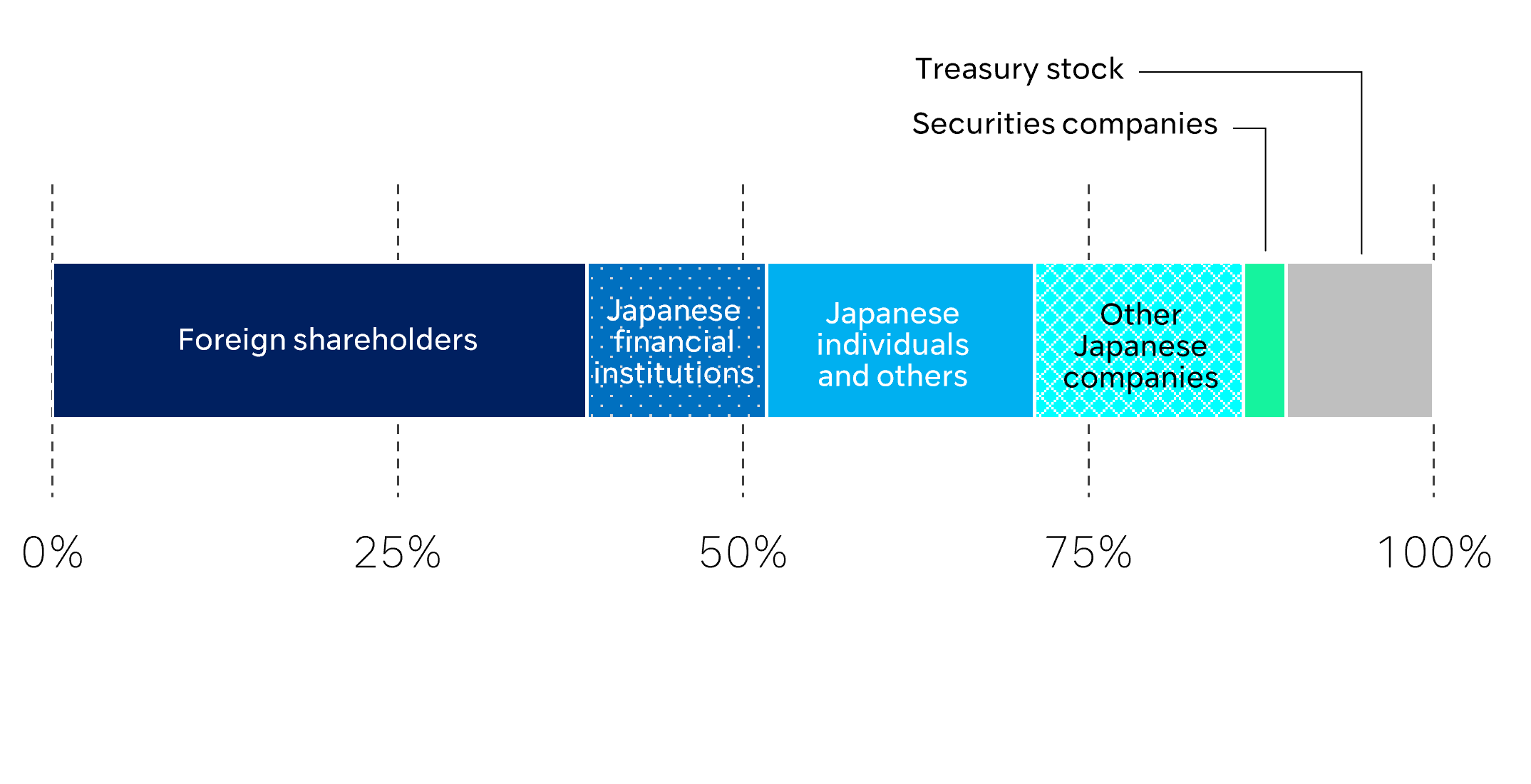

Shareholder CompositionAs of June 30, 2025

| Description | Shareholding ratio(%) | Number of shareholders |

|---|---|---|

| Foreign shareholders | 38.7 | 303 |

| Japanese financial institutions | 13.0 | 16 |

| Japanese individuals and others | 19.4 | 10,001 |

| Other Japanese companies | 15.1 | 113 |

| Securities companies | 3.1 | 38 |

| Treasury stock | 10.7 | 1 |

Stock Split

|

||