Financial Data

Financial Highlights

| Consolidated financial results (JGAAP) | FY2020 (Actual) |

FY2021 (Actual) |

FY2022 (Actual) |

FY2023 (Actual) |

FY2024 (Forecast) |

|---|---|---|---|---|---|

|

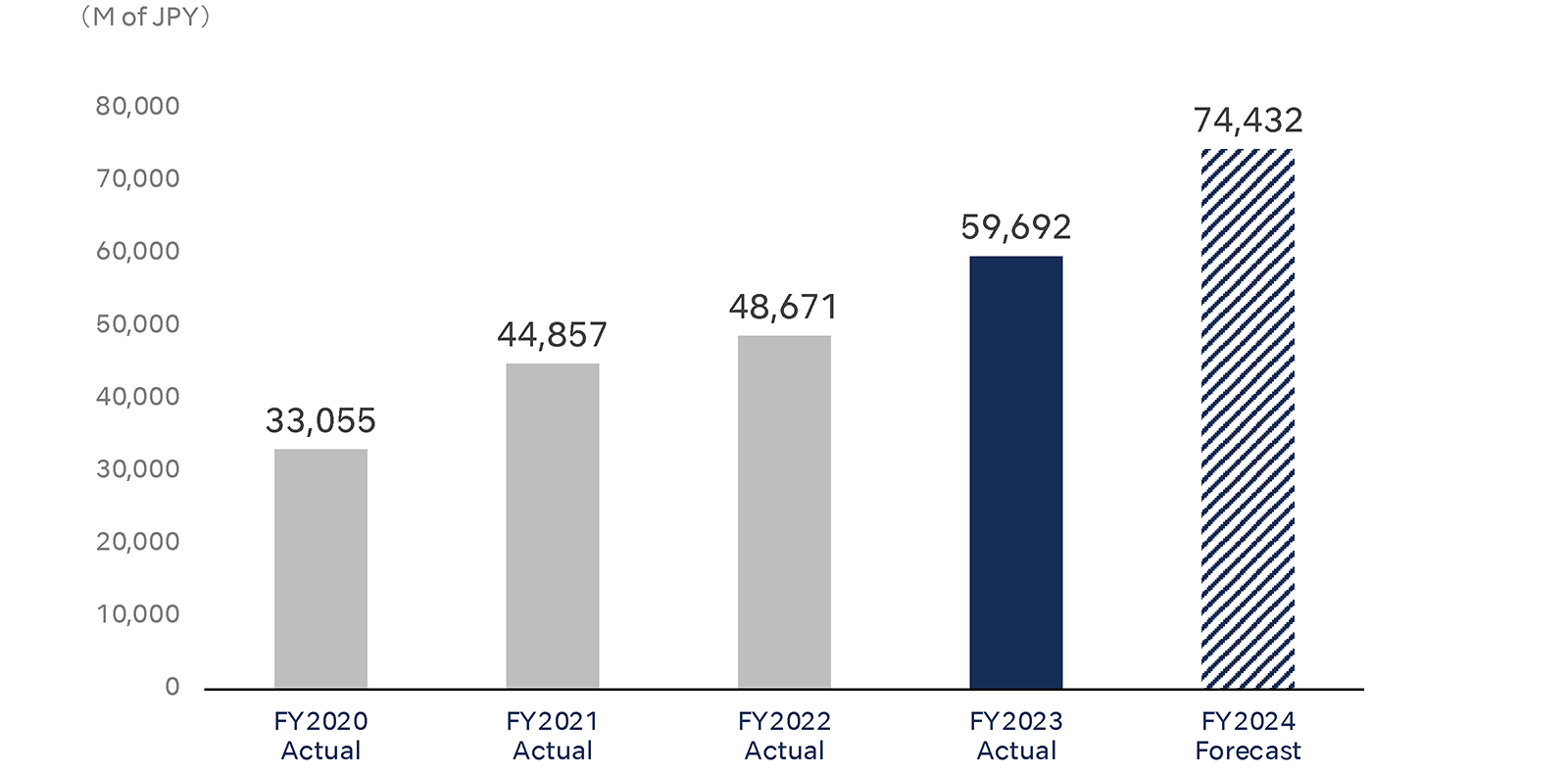

Net salesMillions of JPY |

33,055 | 44,857 | 48,671 | 59,692 | 74,432 |

|

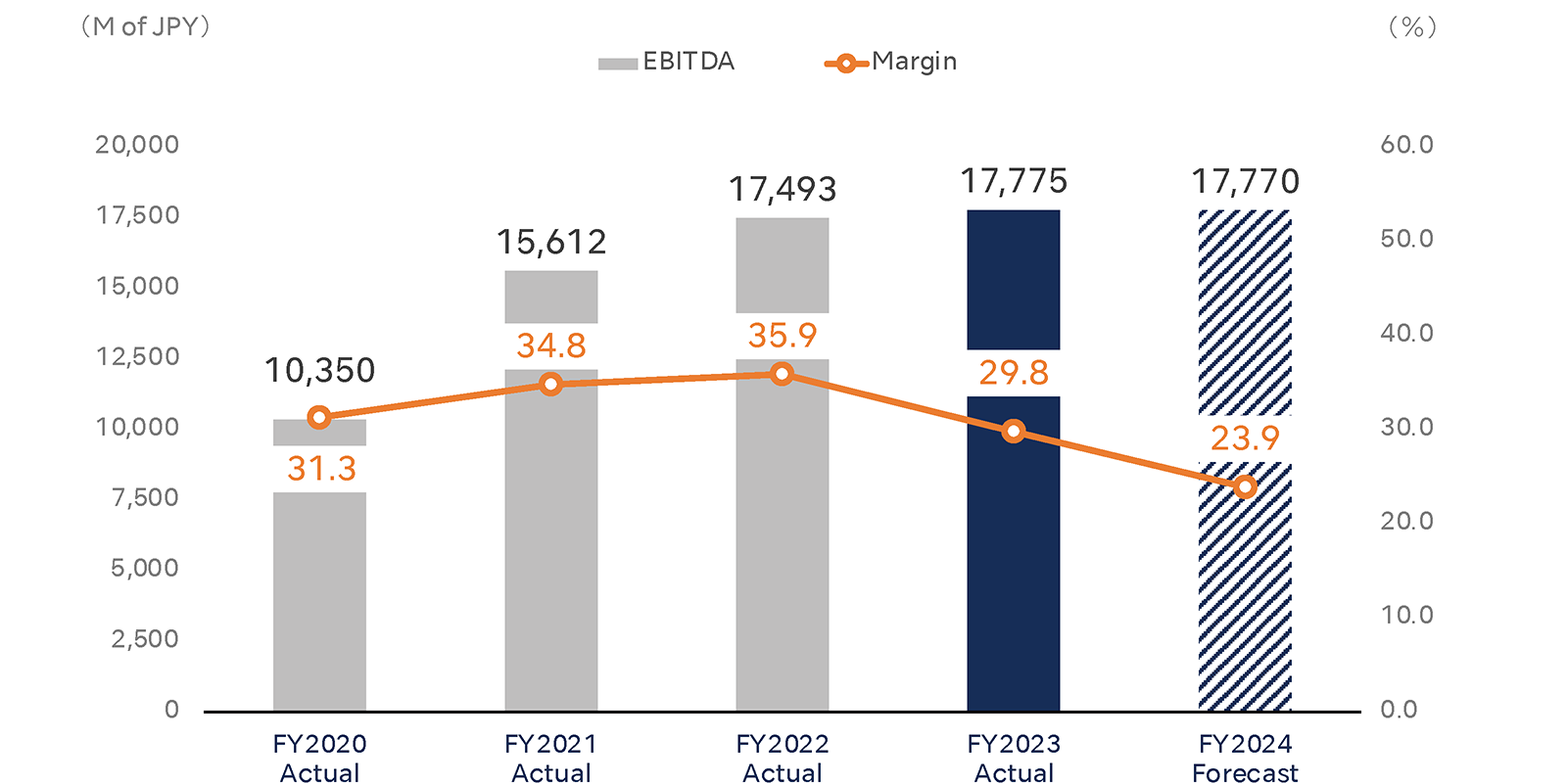

EBITDAMillions of JPY |

10,350 | 15,612 | 17,493 | 17,775 | 17,770 |

|

EBITDA Margin % |

31.3 | 34.8 | 35.9 | 29.8 | 23.9 |

|

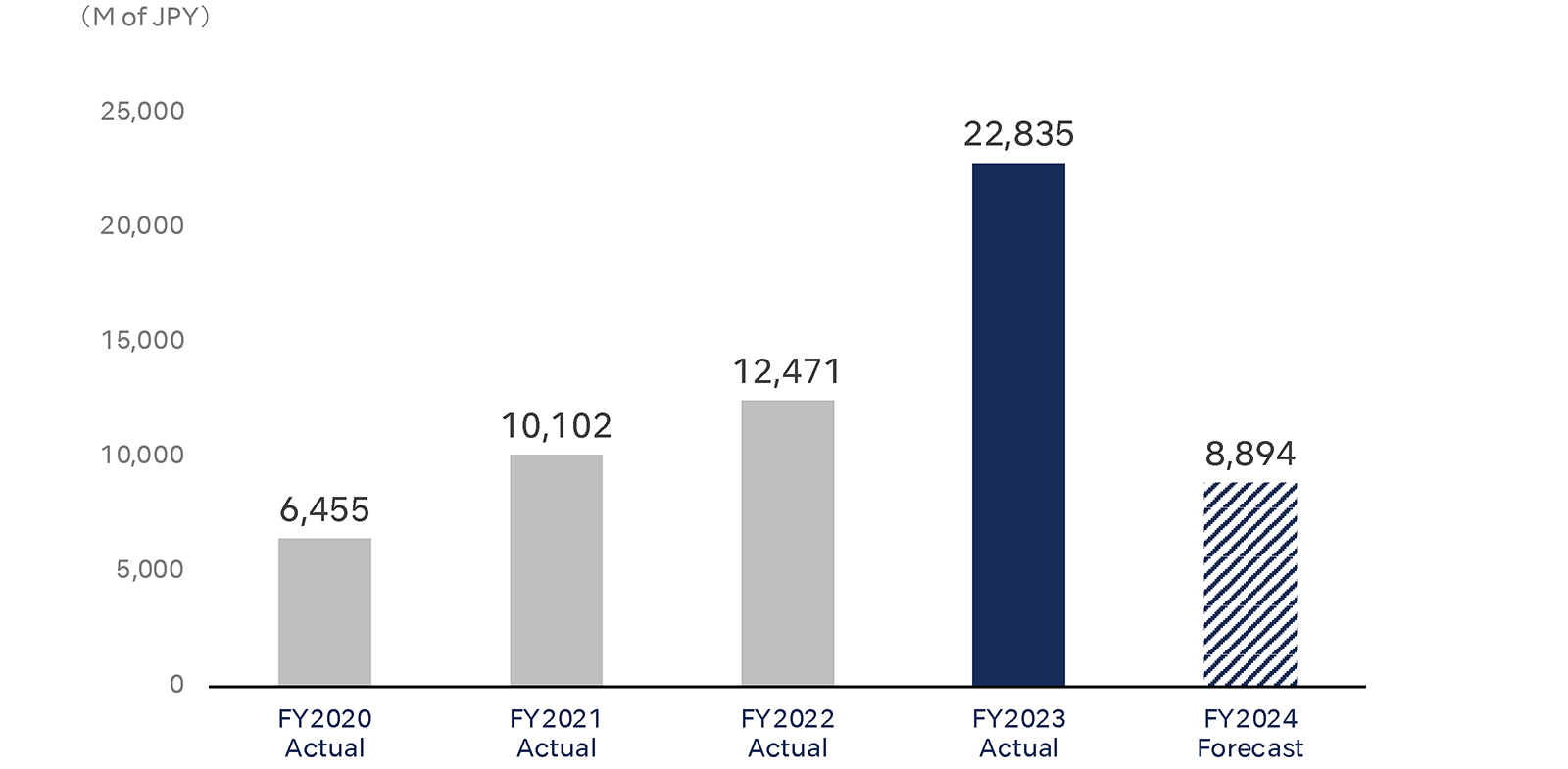

Profit attributable to owners of parentMillions of JPY |

6,455 | 10,102 | 12,471 | 22,835 | 8,894 |

|

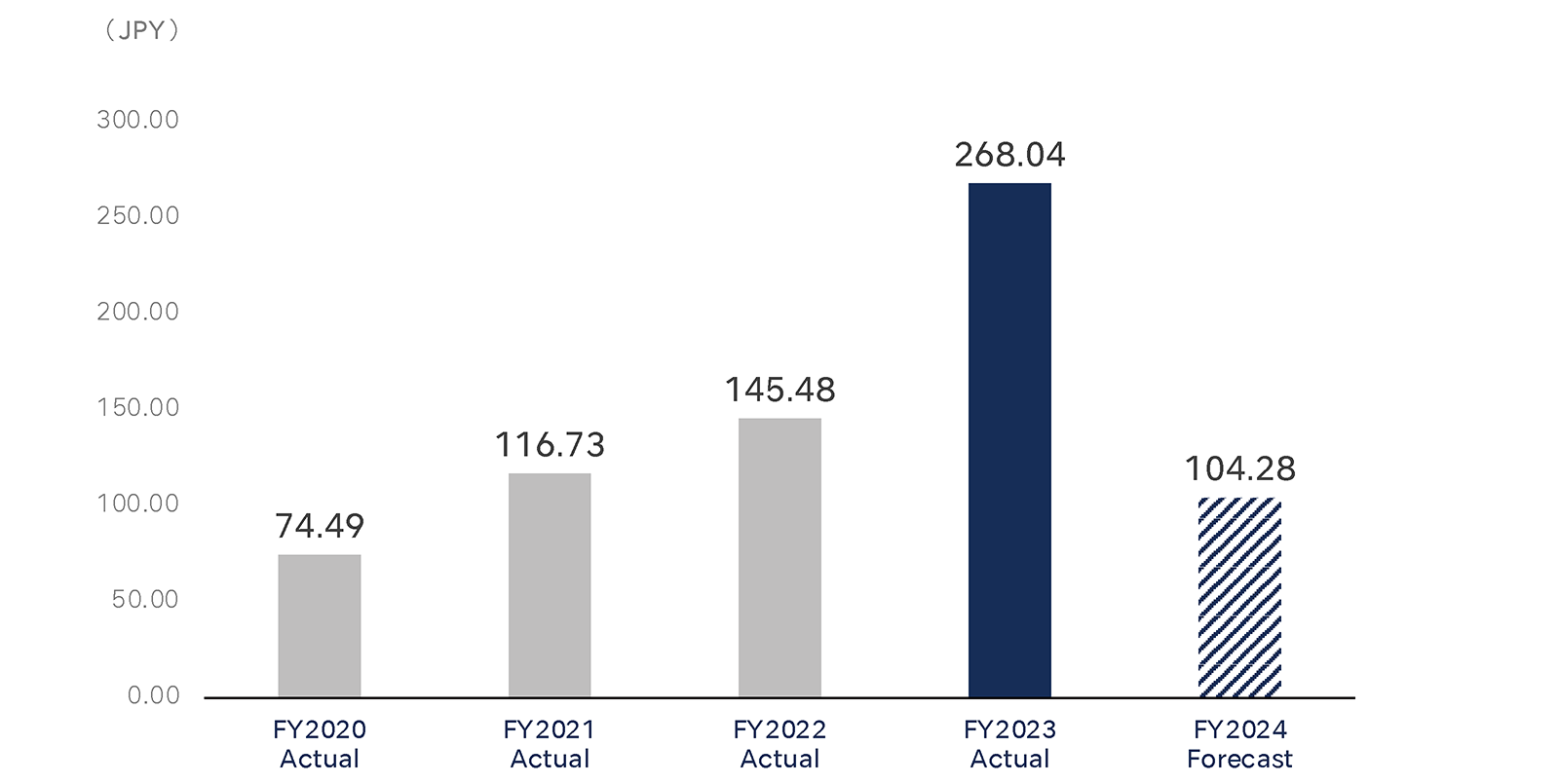

Earnings per share JPY |

74.49 | 116.73 | 145.48 | 268.04 | 104.28 |

Net sales

EBITDA / Margin

Profit attributable to owners of parent

Key Financial Data

| Consolidated financial results (JGAAP) | FY2019 Actual |

FY2020 Actual |

FY2021 Actual |

FY2022 Actual |

FY2023 Actual |

|---|---|---|---|---|---|

|

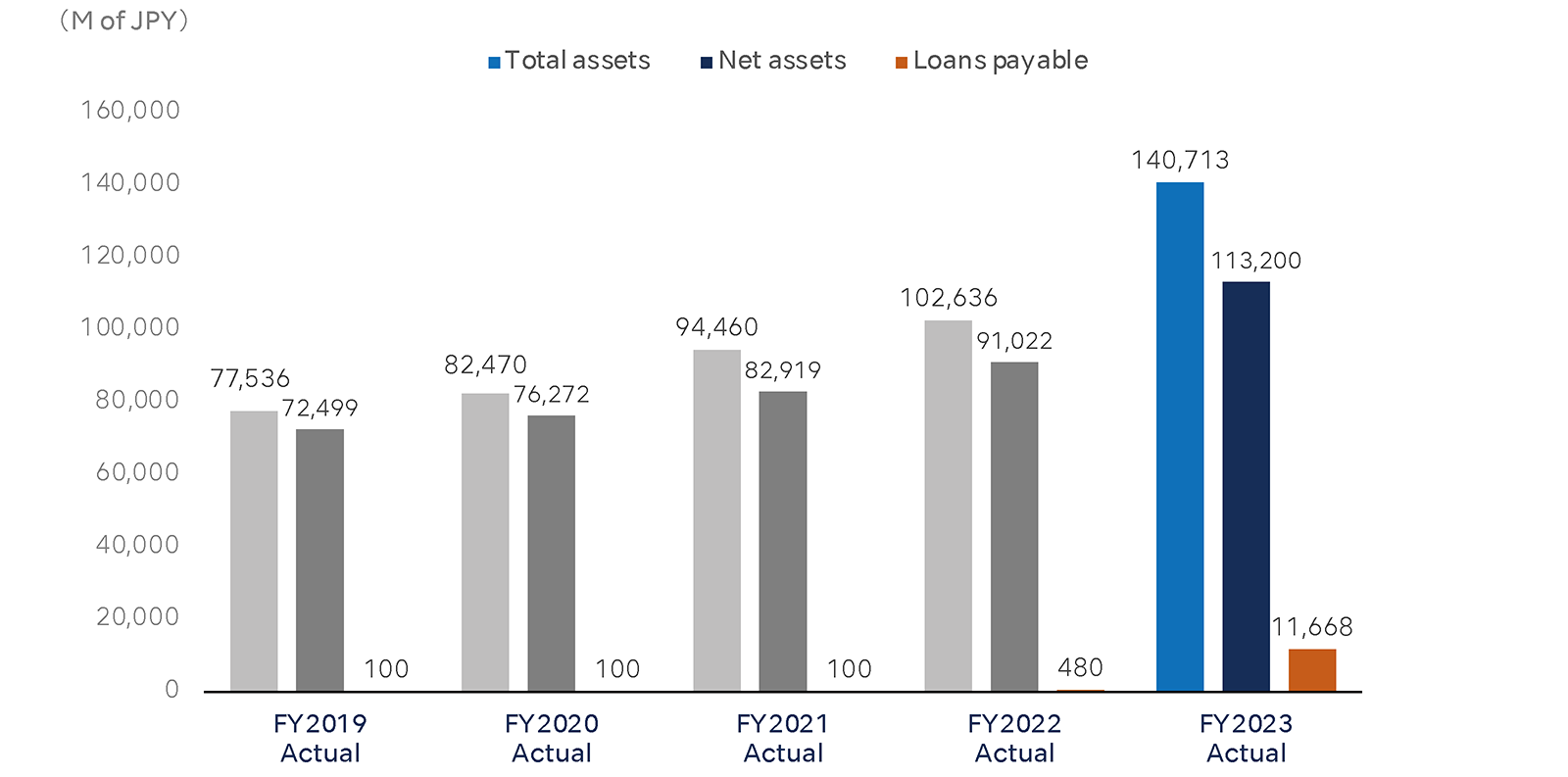

Total assetsMillions of JPY |

77,536 | 82,470 | 94,460 | 102,154 | 140,713 |

|

Net assetsMillions of JPY |

72,499 | 76,272 | 82,919 | 91,022 | 113,200 |

|

Loans payableMillions of JPY |

100 | 100 | 100 | 480 | 11,668 |

|

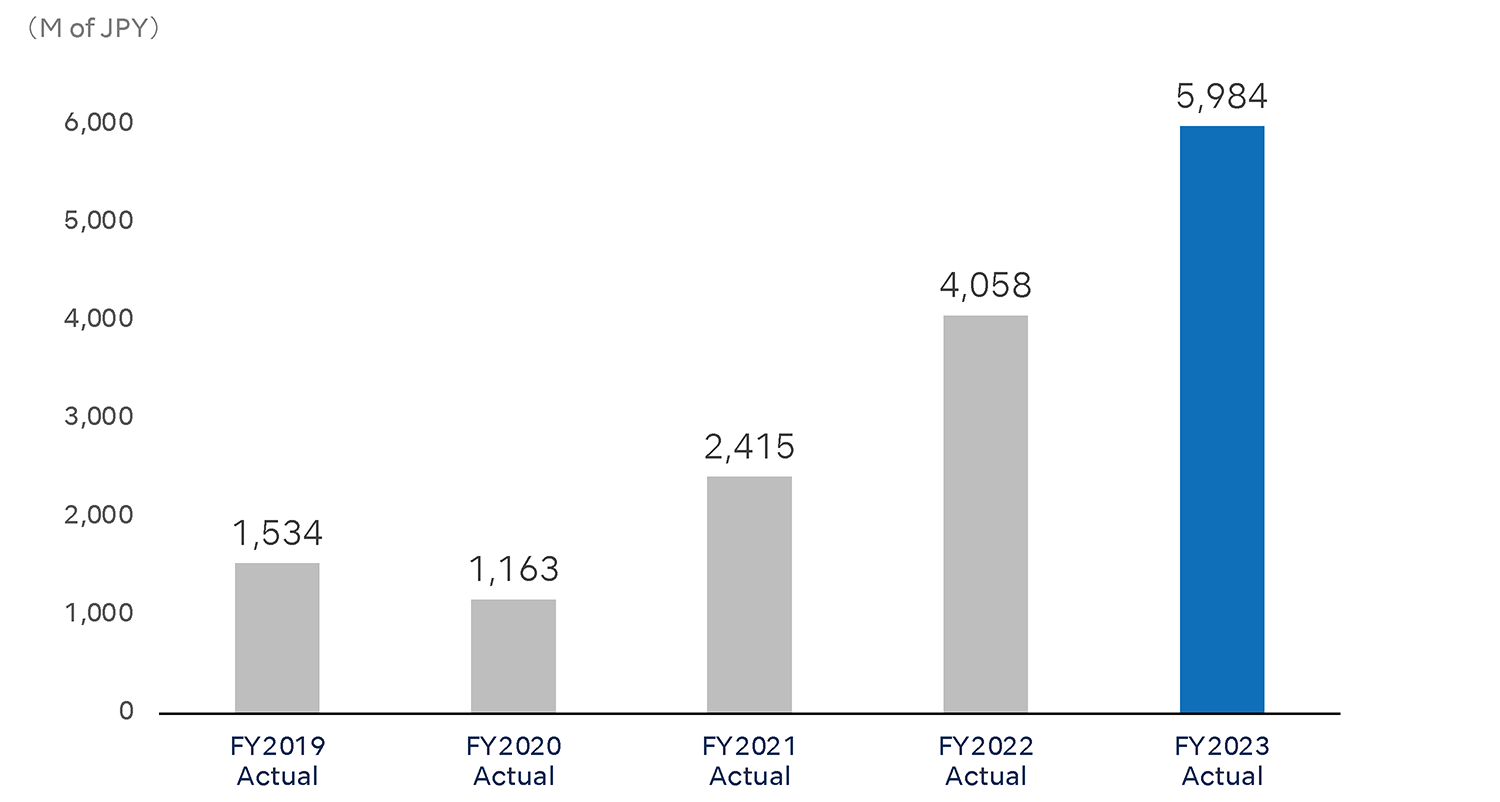

Capital investmentsMillions of JPY |

1,534 | 1,163 | 2,415 | 4,058 | 5,984 |

|

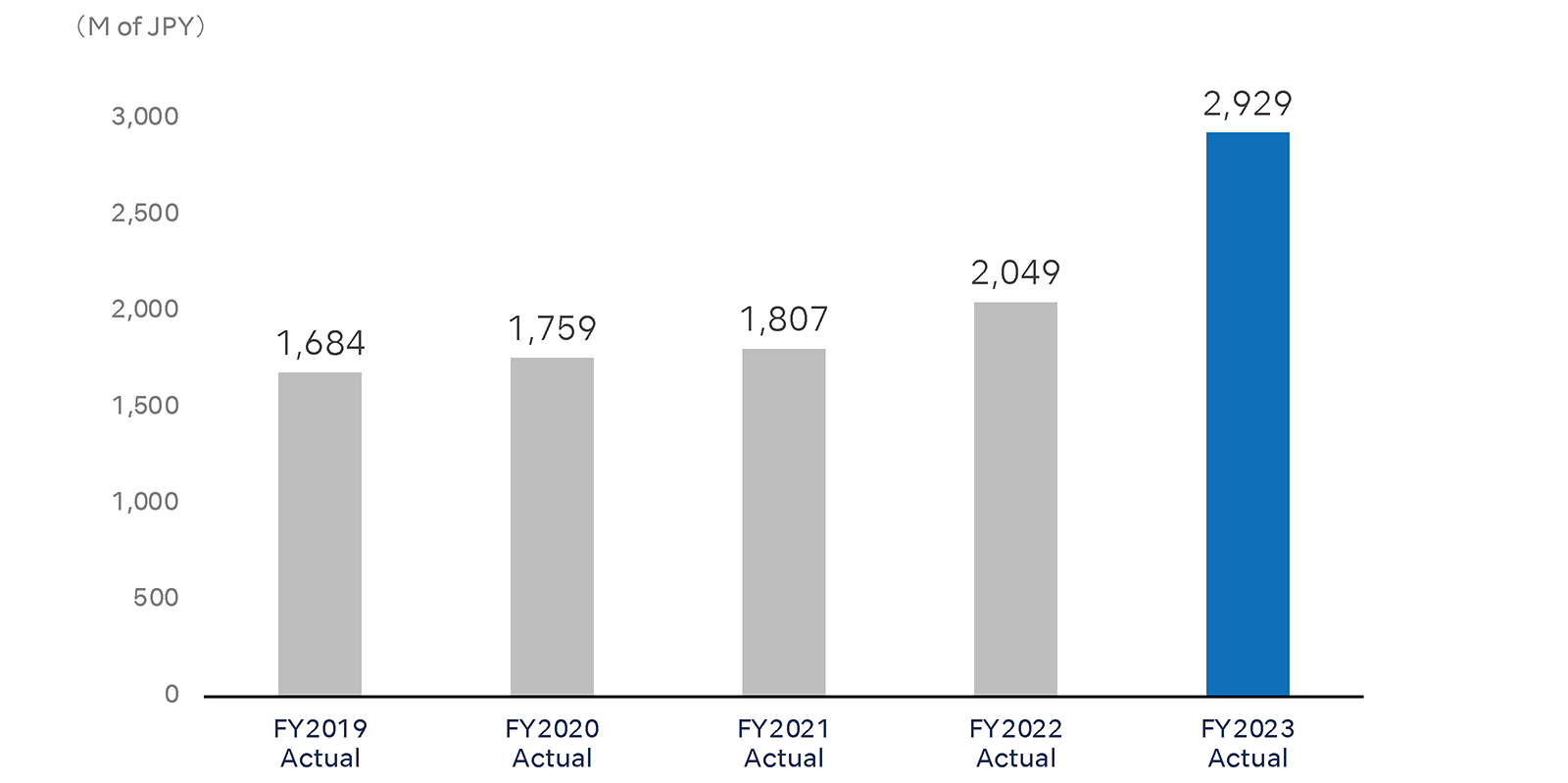

Depreciation expensesMillions of JPY |

1,684 | 1,759 | 1,807 | 2,049 | 2,929 |

|

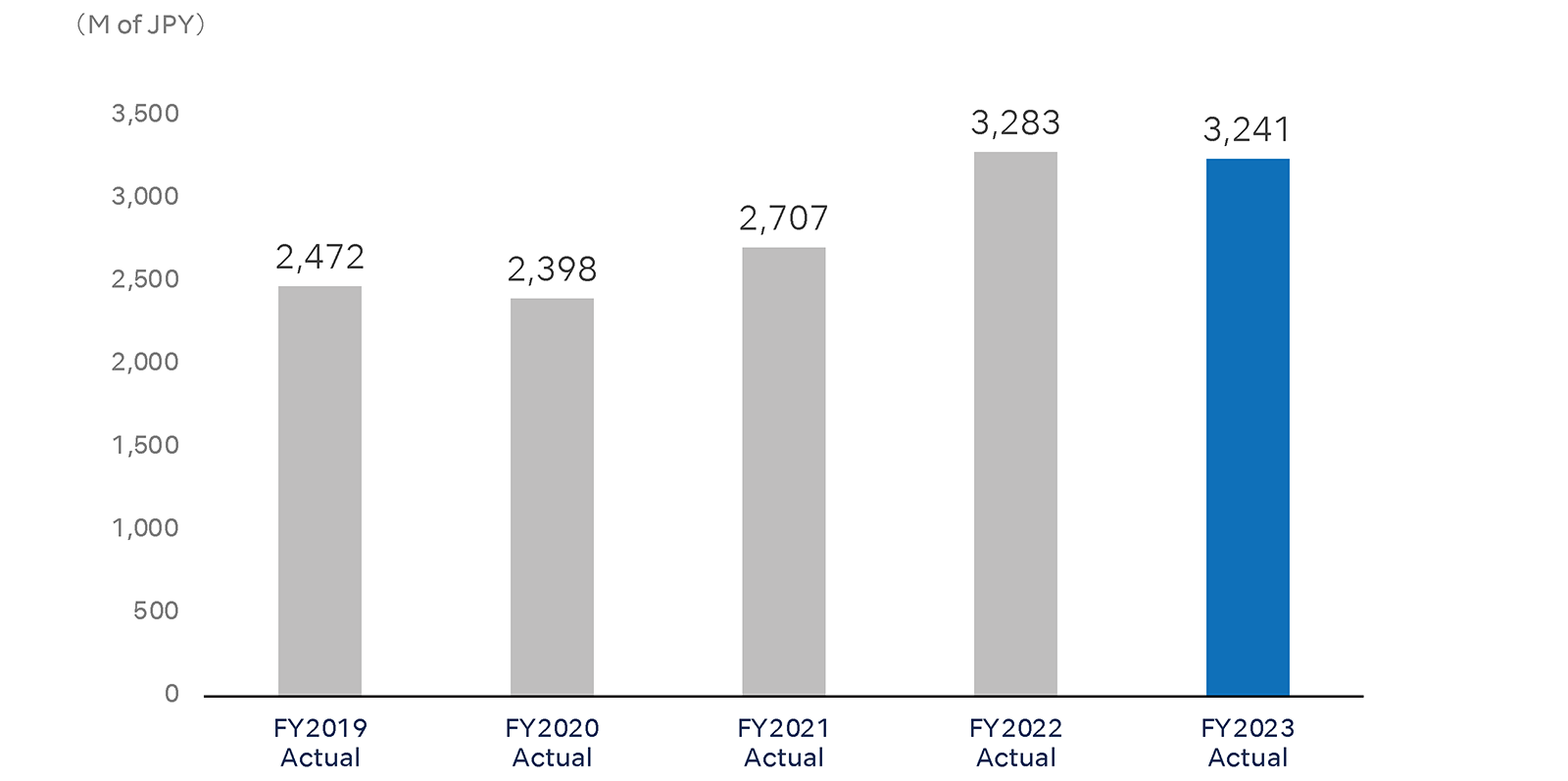

R&D expensesMillions of JPY |

2,472 | 2,398 | 2,707 | 3,283 | 3,241 |

|

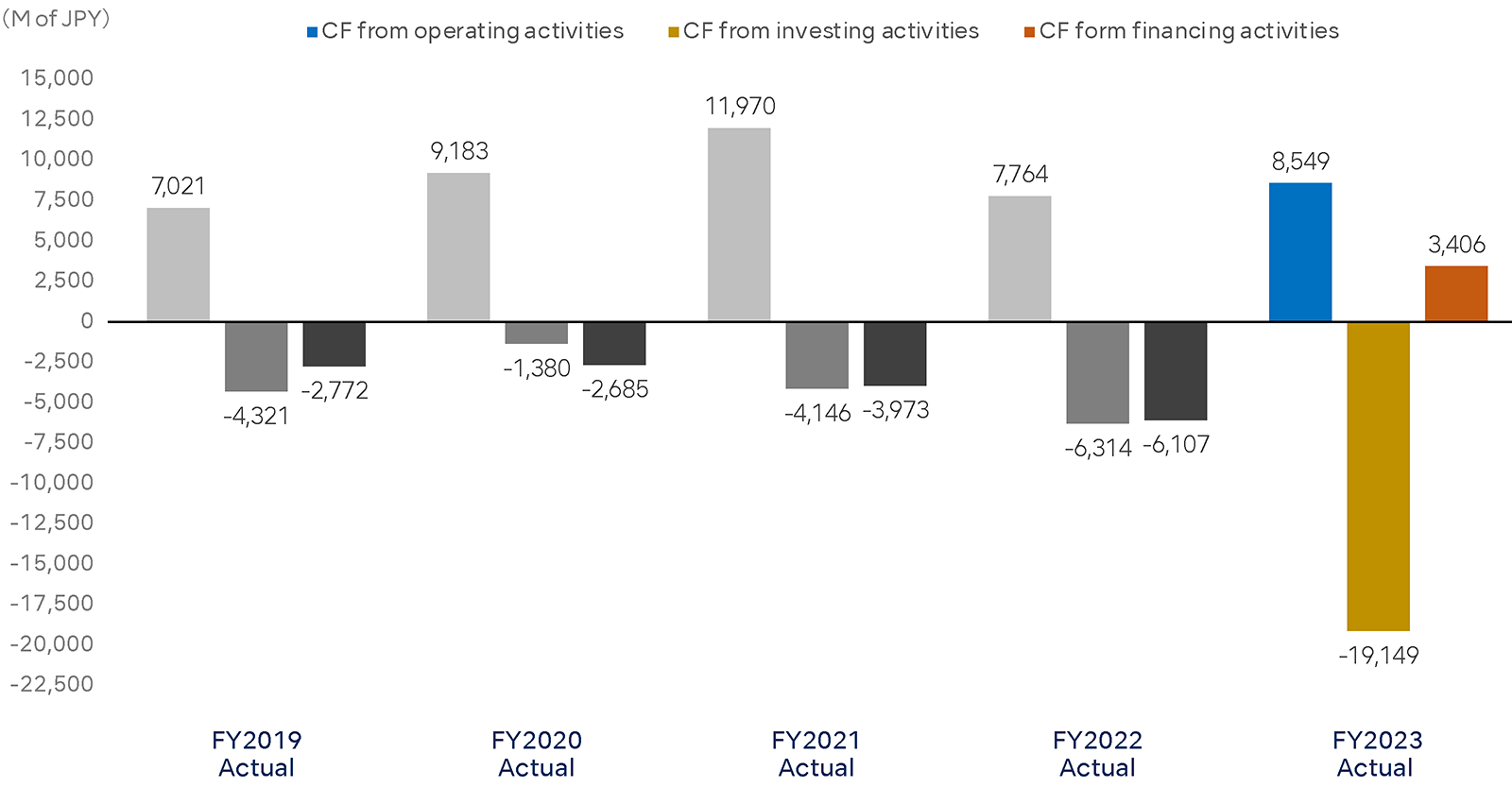

Cash flows from operating activitiesMillions of JPY |

7,021 | 9,183 | 11,970 | 7,764 | 8,549 |

|

Cash flows from investing activitiesMillions of JPY |

-4,321 | -1,380 | -4,146 | -6,314 | -19,149 |

|

Cash flows from financing activitiesMillions of JPY |

-2,772 | -2,685 | -3,973 | -6,107 | 3,406 |

Total assets・Net assets・Loans payable

Capital investments

Depreciation expenses

R&D expenses

Cash flows from operating activities・investing activities・financing activities

Financial Position

| Consolidated financial results (JGAAP) | FY2019 Actual |

FY2020 Actual |

FY2021 Actual |

FY2022 Actual |

FY2023 Actual |

|---|---|---|---|---|---|

|

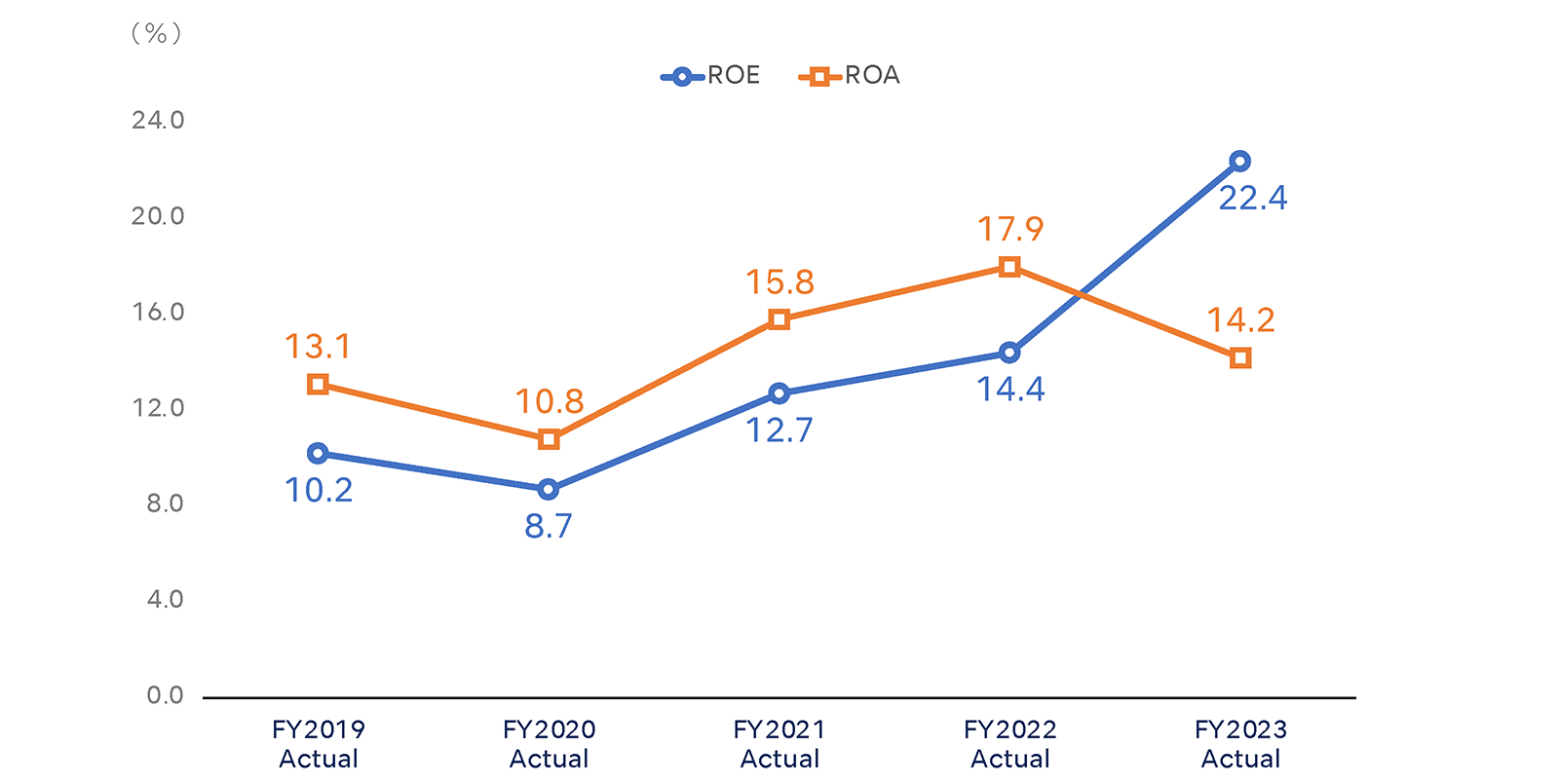

Return on equity (ROE) % |

10.2 | 8.7 | 12.7 | 14.4 | 22.4 |

|

Return on assets (ROA) % |

13.1 | 10.8 | 15.8 | 17.9 | 14.2 |

|

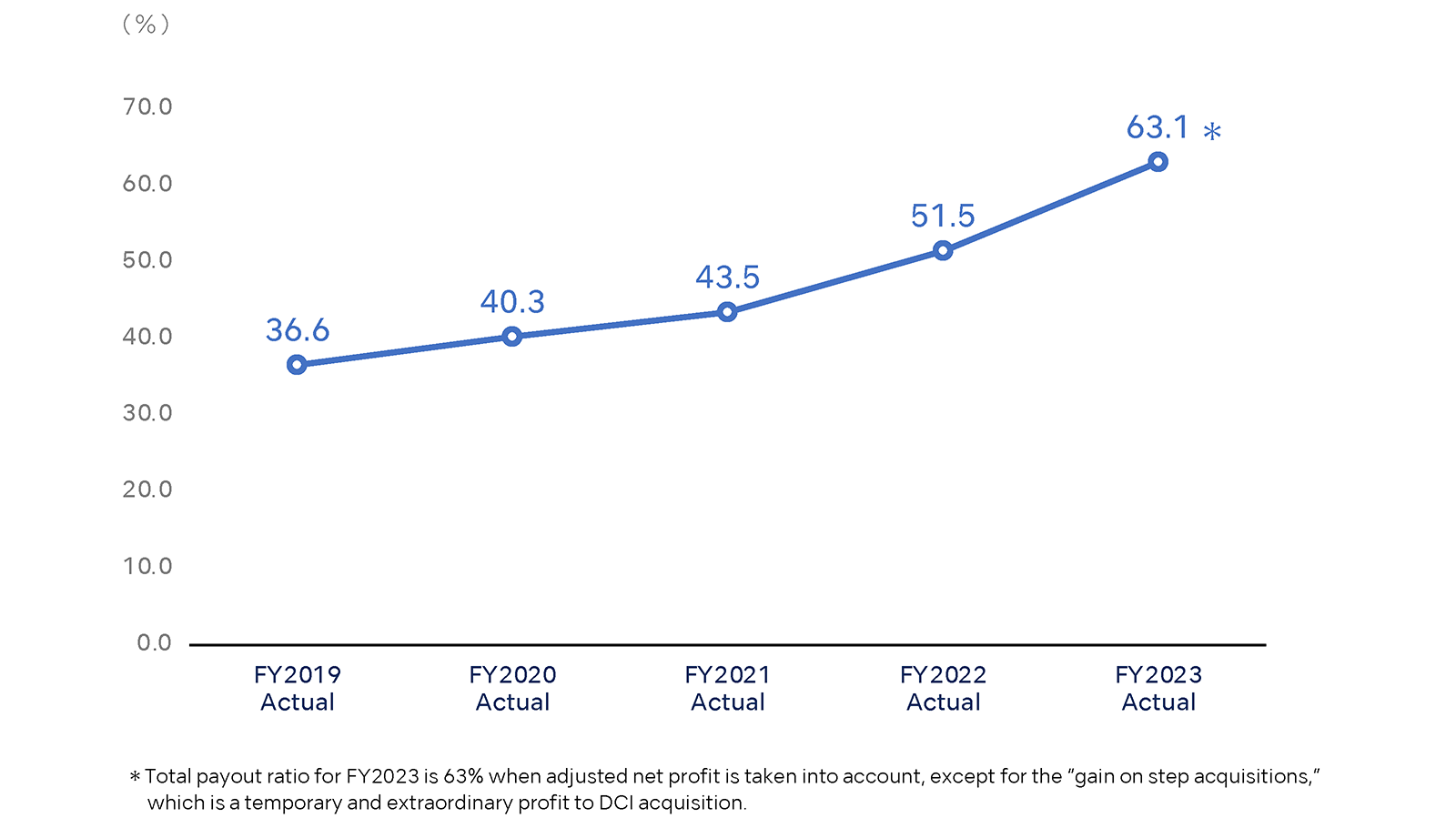

Total payout ratio % |

36.6 | 40.3 | 43.5 | 51.5 | 63.1 |

|

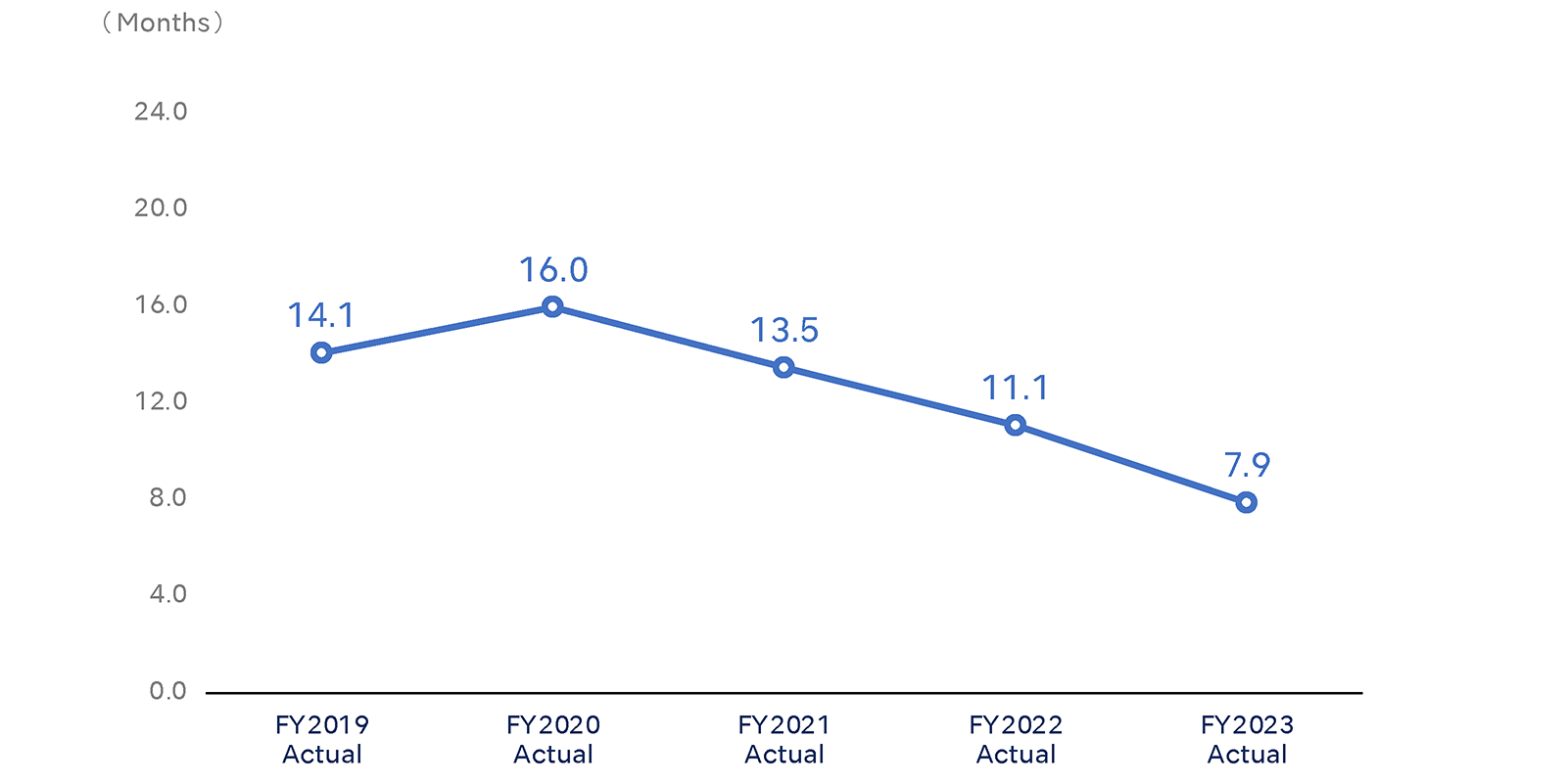

Cash & marketable securities to monthly sales ratio Months |

14.1 | 16.0 | 13.5 | 11.1 | 7.9 |

- ROE = Profit attributable to owners of parent / Average net assets

- ROA = Ordinary profit / Average total assets

- Total payout ratio = (Total annual dividend + Total amount of repurchase costs) / Profit attributable to owners of parent

- Cash & marketable securities to monthly sales ratio = (Cash + Money held in trust + marketable securities + Investment securities) / (Net sales / 12 months)

ROE・ROA

Total payout ratio

Cash & marketable securities to monthly sales ratio