Financial Data

Financial Highlights

| Consolidated financial results (JGAAP) | FY2021 (Actual) |

FY2022 (Actual) |

FY2023 (Actual) |

FY2024 (Actual) |

FY2025 (Forecast) |

|---|---|---|---|---|---|

|

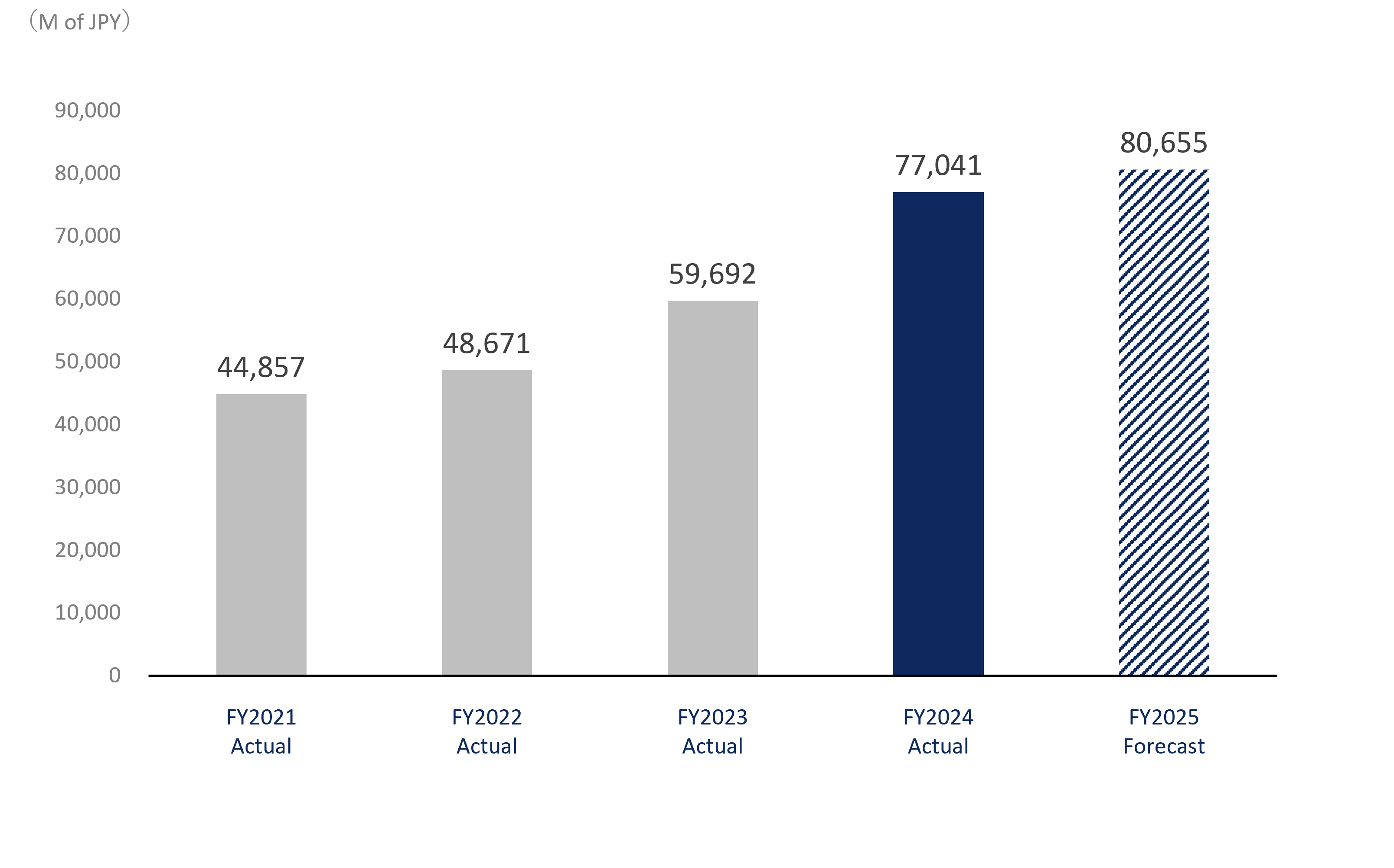

Net salesMillions of JPY |

44,857 | 48,671 | 59,692 | 77,041 | 80,655 |

|

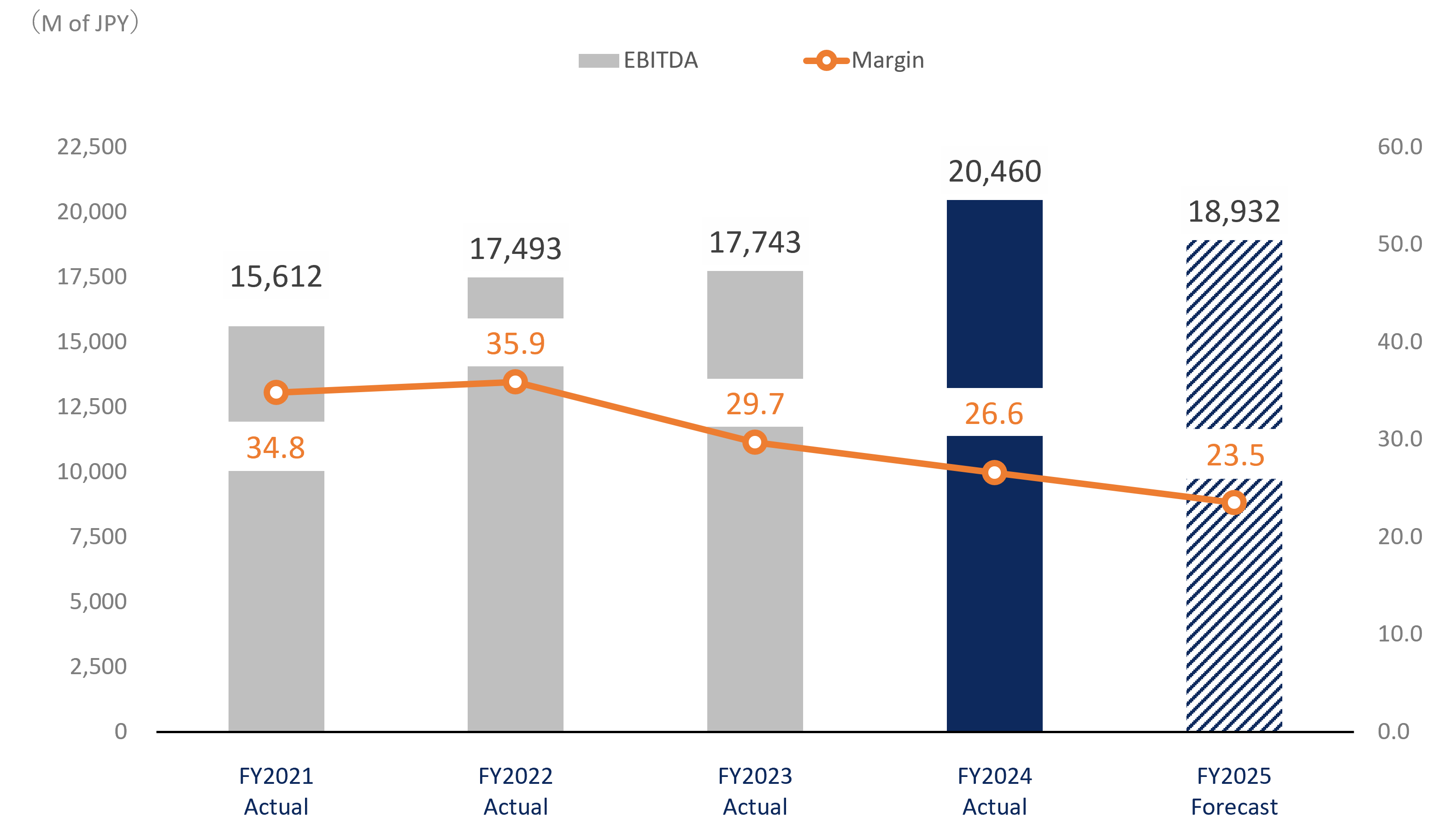

EBITDAMillions of JPY |

15,612 | 17,493 | 17,743 | 20,460 | 18,932 |

|

EBITDA Margin % |

34.8 | 35.9 | 29.7 | 26.6 | 23.5 |

|

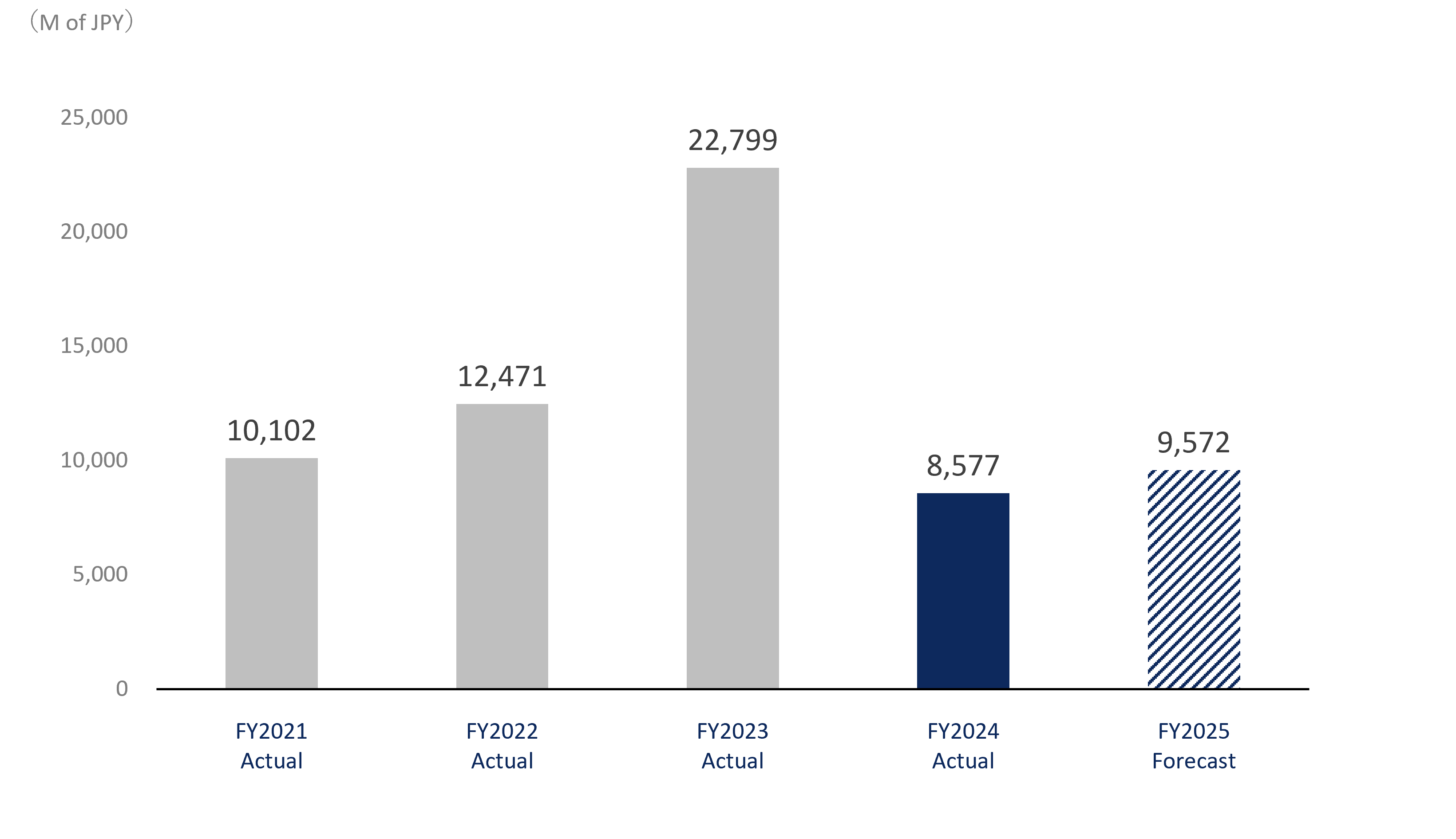

Profit attributable to owners of parentMillions of JPY |

10,102 | 12,471 | 22,799 | 8,577 | 9,572 |

|

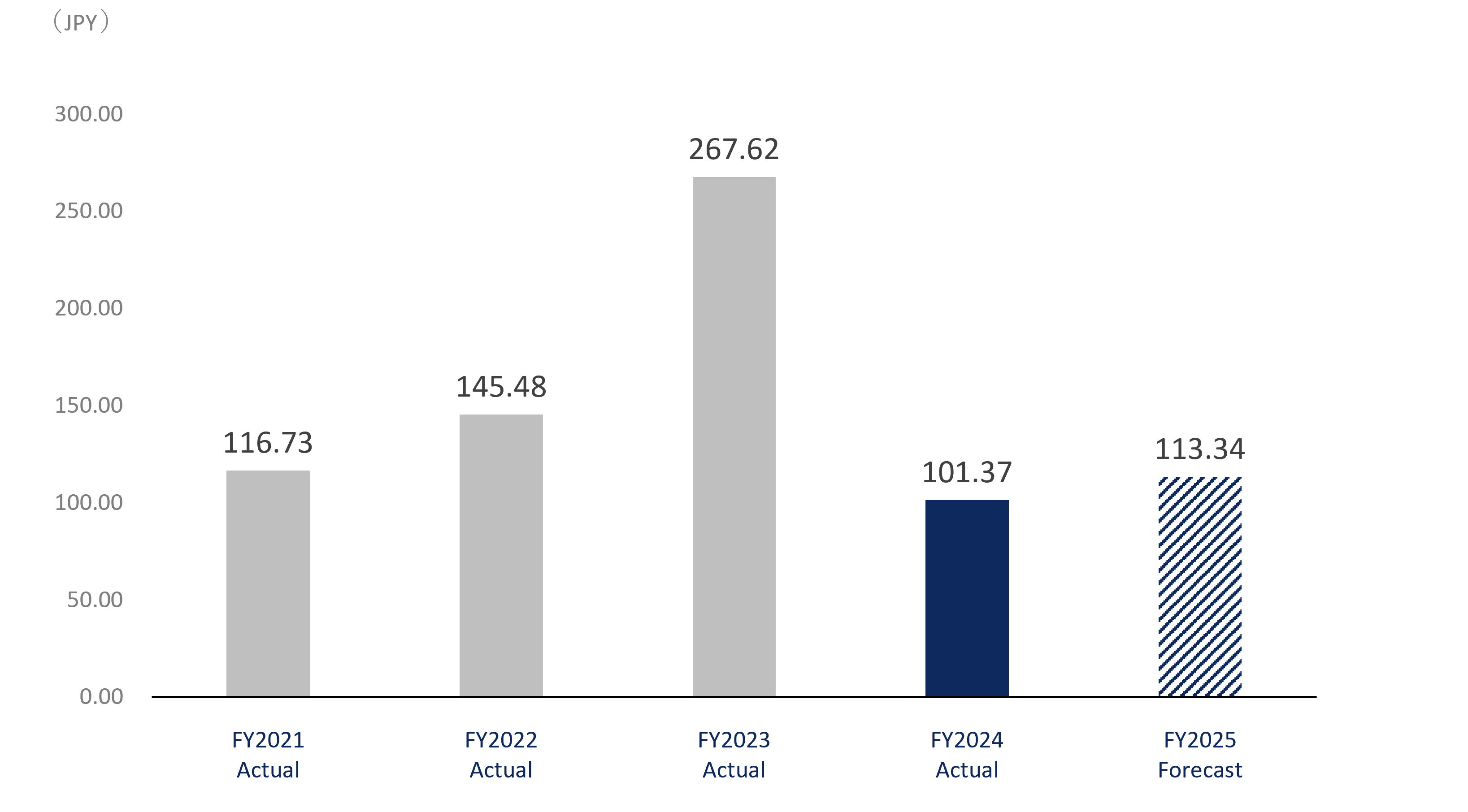

Earnings per share JPY |

116.73 | 145.48 | 267.62 | 101.37 | 113.34 |

Net sales

EBITDA / Margin

Profit attributable to owners of parent

Key Financial Data

| Consolidated financial results (JGAAP) | FY2020 Actual |

FY2021 Actual |

FY2022 Actual |

FY2023 Actual |

FY2024 Actual |

|---|---|---|---|---|---|

|

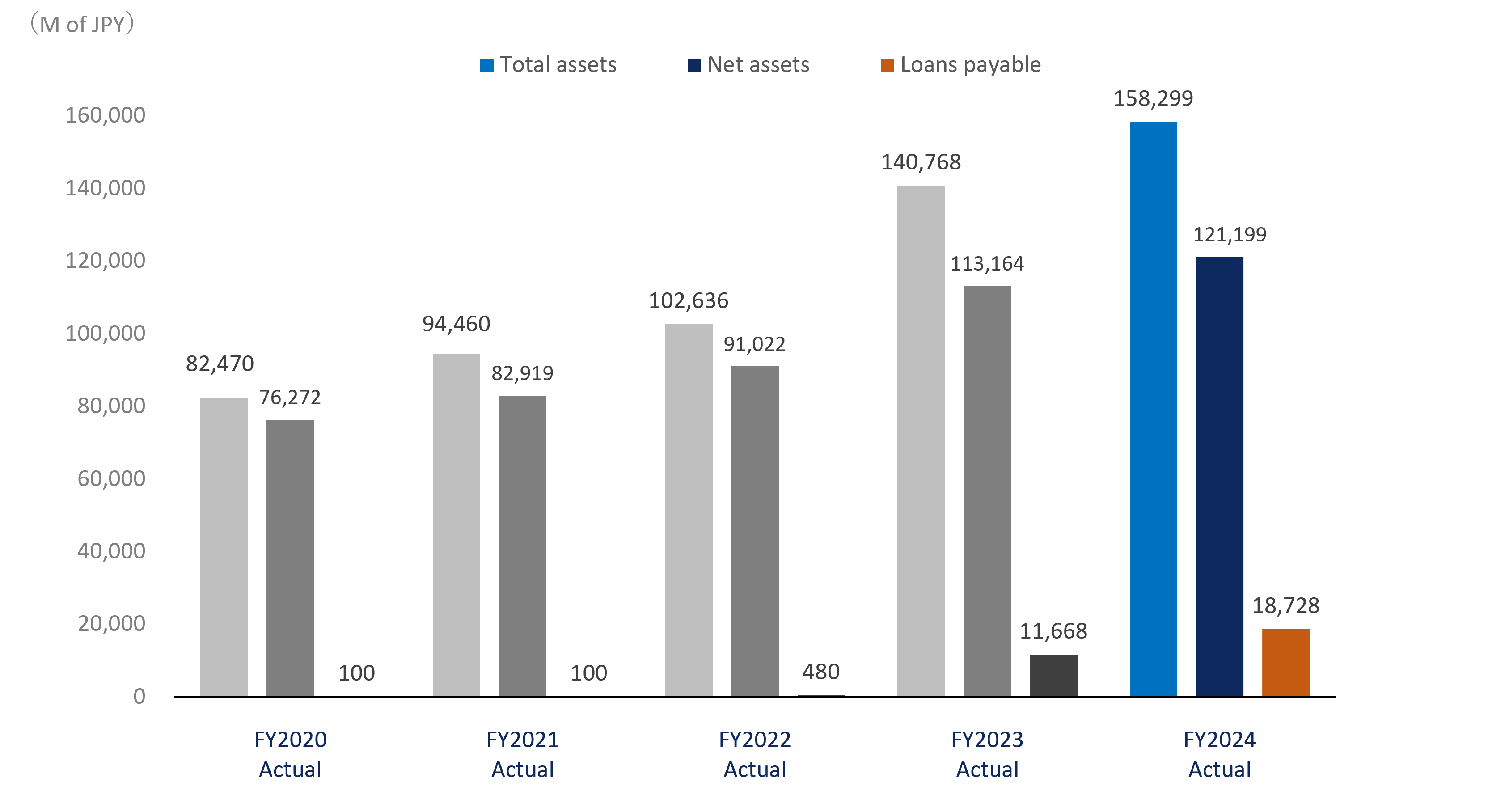

Total assetsMillions of JPY |

82,470 | 94,460 | 102,636 | 140,768 | 158,299 |

|

Net assetsMillions of JPY |

76,272 | 82,919 | 91,022 | 113,164 | 121,199 |

|

Loans payableMillions of JPY |

100 | 100 | 480 | 11,668 | 18,728 |

|

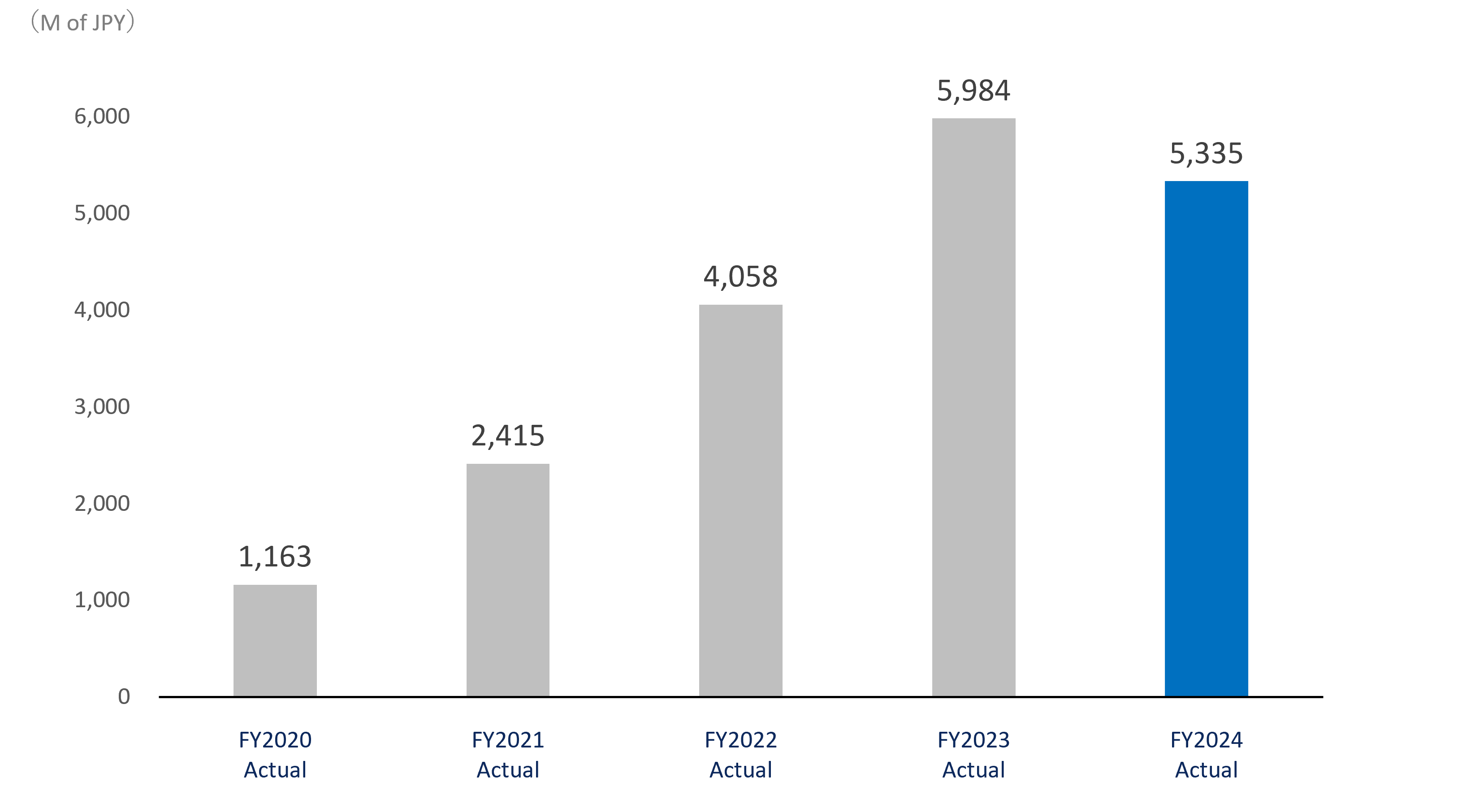

Capital investmentsMillions of JPY |

1,163 | 2,415 | 4,058 | 5,984 | 5,335 |

|

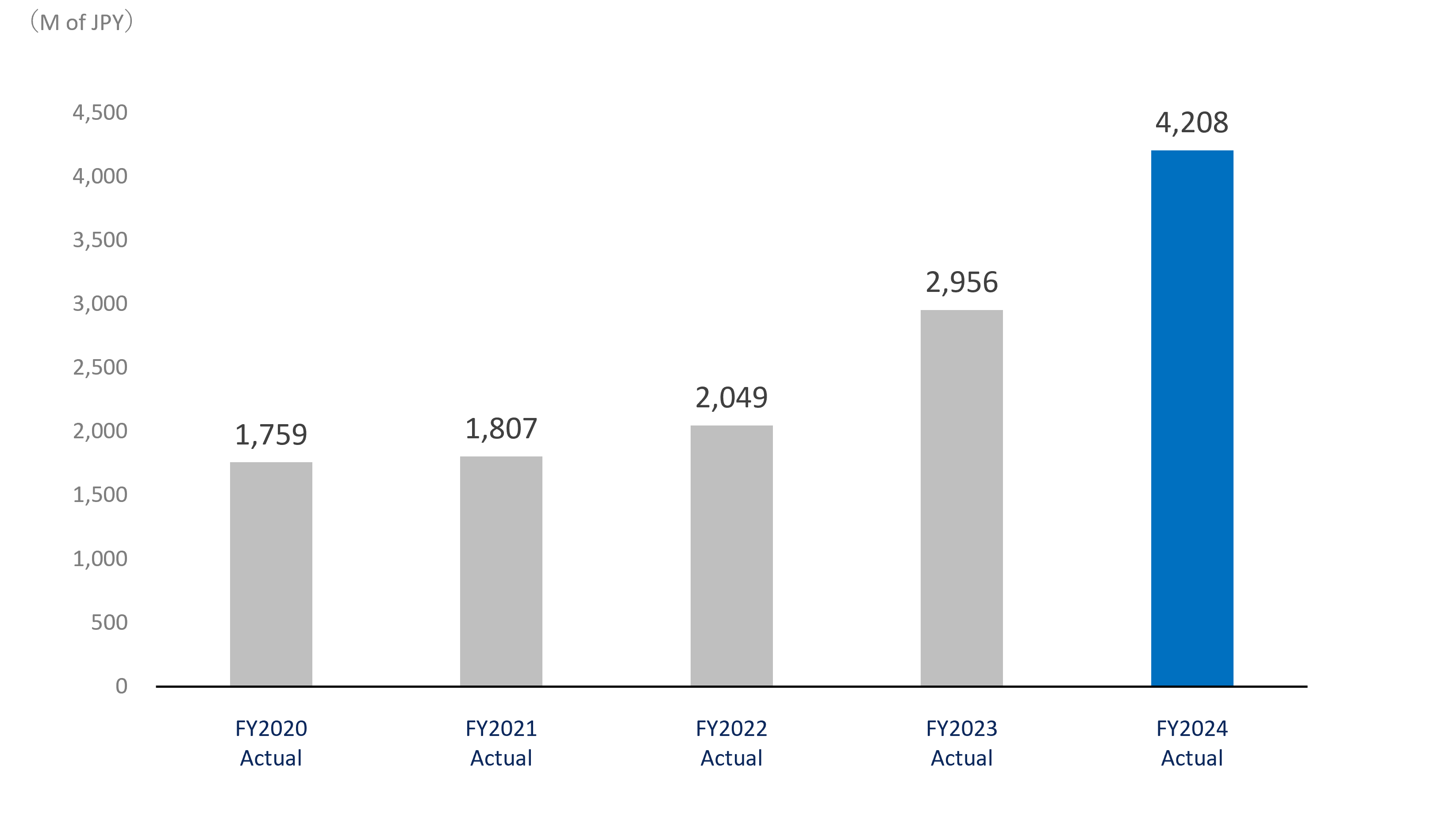

Depreciation expensesMillions of JPY |

1,759 | 1,807 | 2,049 | 2,956 | 4,208 |

|

R&D expensesMillions of JPY |

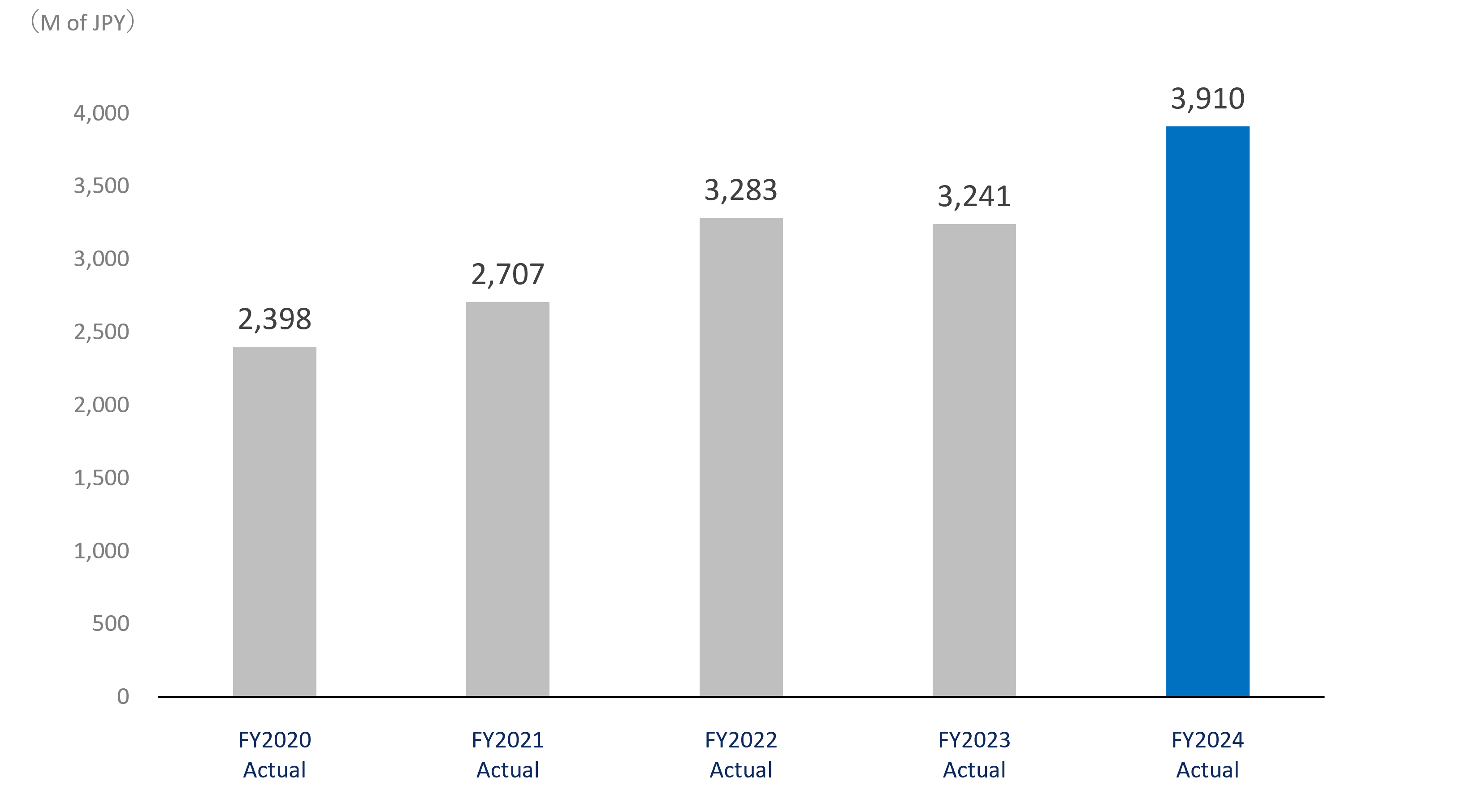

2,398 | 2,707 | 3,283 | 3,241 | 3,910 |

|

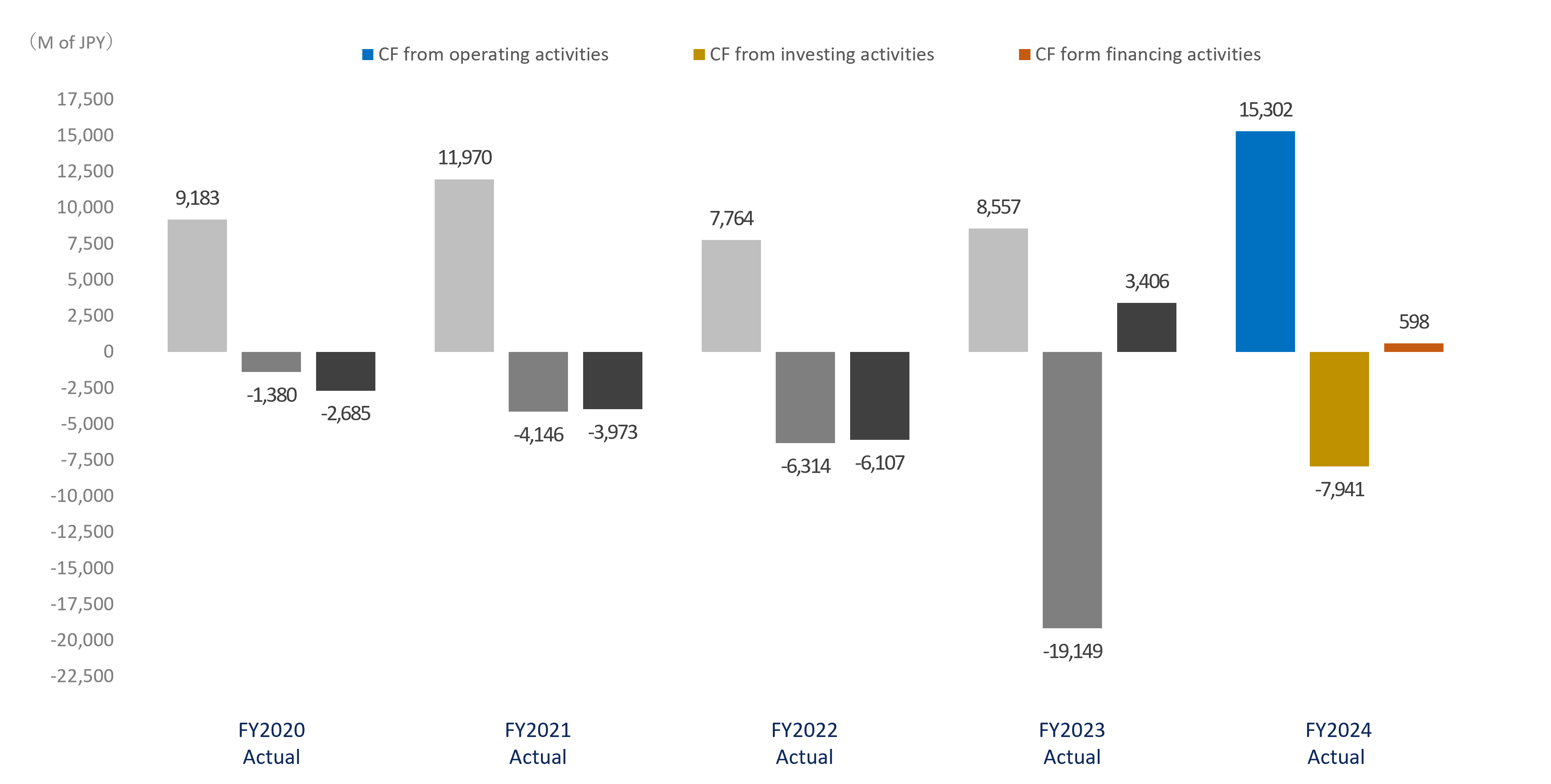

Cash flows from operating activitiesMillions of JPY |

9,183 | 11,970 | 7,764 | 8,557 | 15,302 |

|

Cash flows from investing activitiesMillions of JPY |

-1,380 | -4,146 | -6,314 | -19,149 | -7,941 |

|

Cash flows from financing activitiesMillions of JPY |

-2,685 | -3,973 | -6,107 | 3,406 | 598 |

Total assets / Net assets / Loans payable

Capital investments

Depreciation expenses

R&D expenses

Cash flows

Financial Position

| Consolidated financial results (JGAAP) | FY2020 Actual |

FY2021 Actual |

FY2022 Actual |

FY2023 Actual |

FY2024 Actual |

|---|---|---|---|---|---|

|

Return on equity (ROE) % |

8.7 | 12.7 | 14.4 | 22.4 | 7.3 |

|

Return on assets (ROA) % |

10.8 | 15.8 | 17.9 | 14.2 | 11.6 |

|

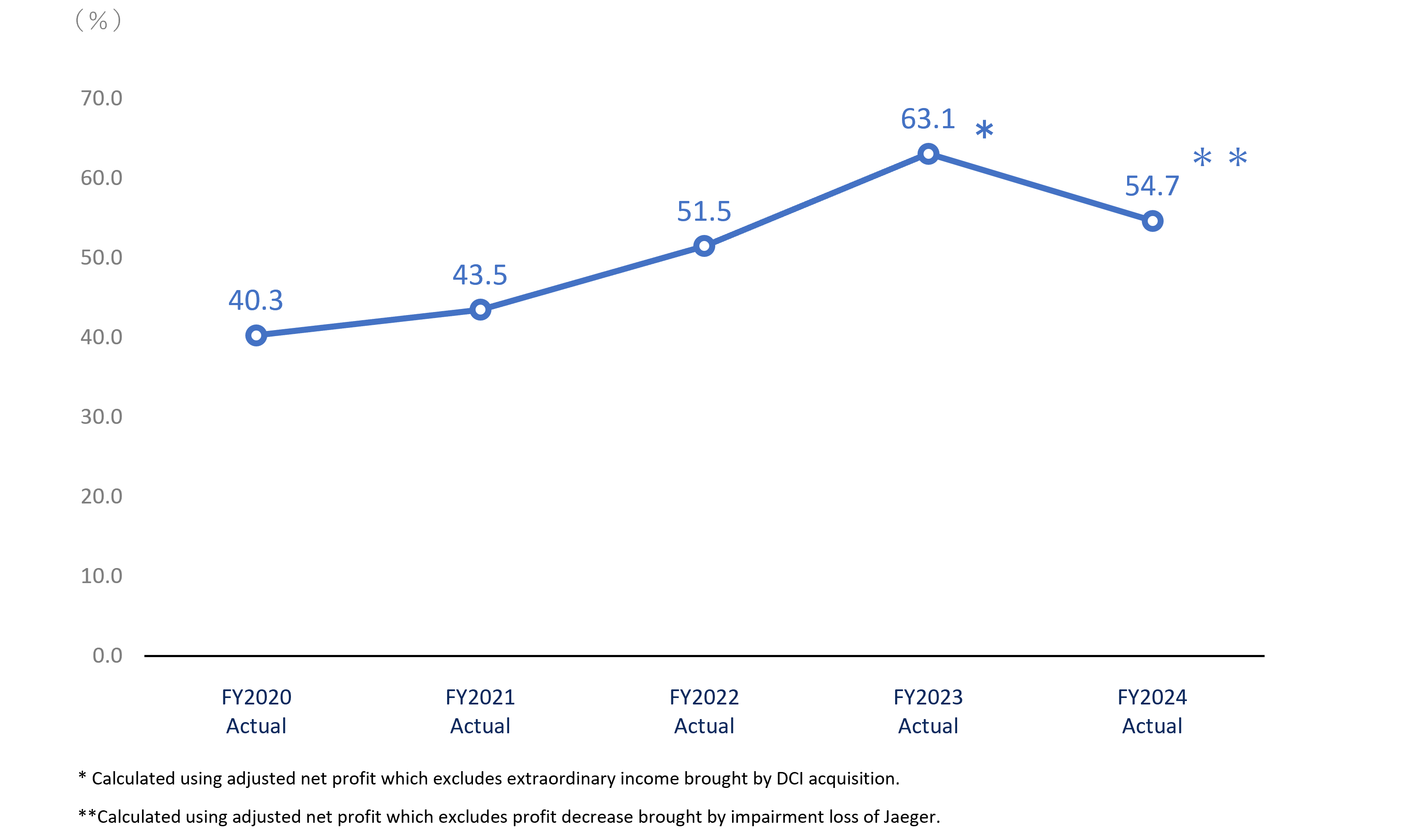

Total payout ratio % |

40.3 | 43.5 | 51.5 | 63.1 | 54.7 |

|

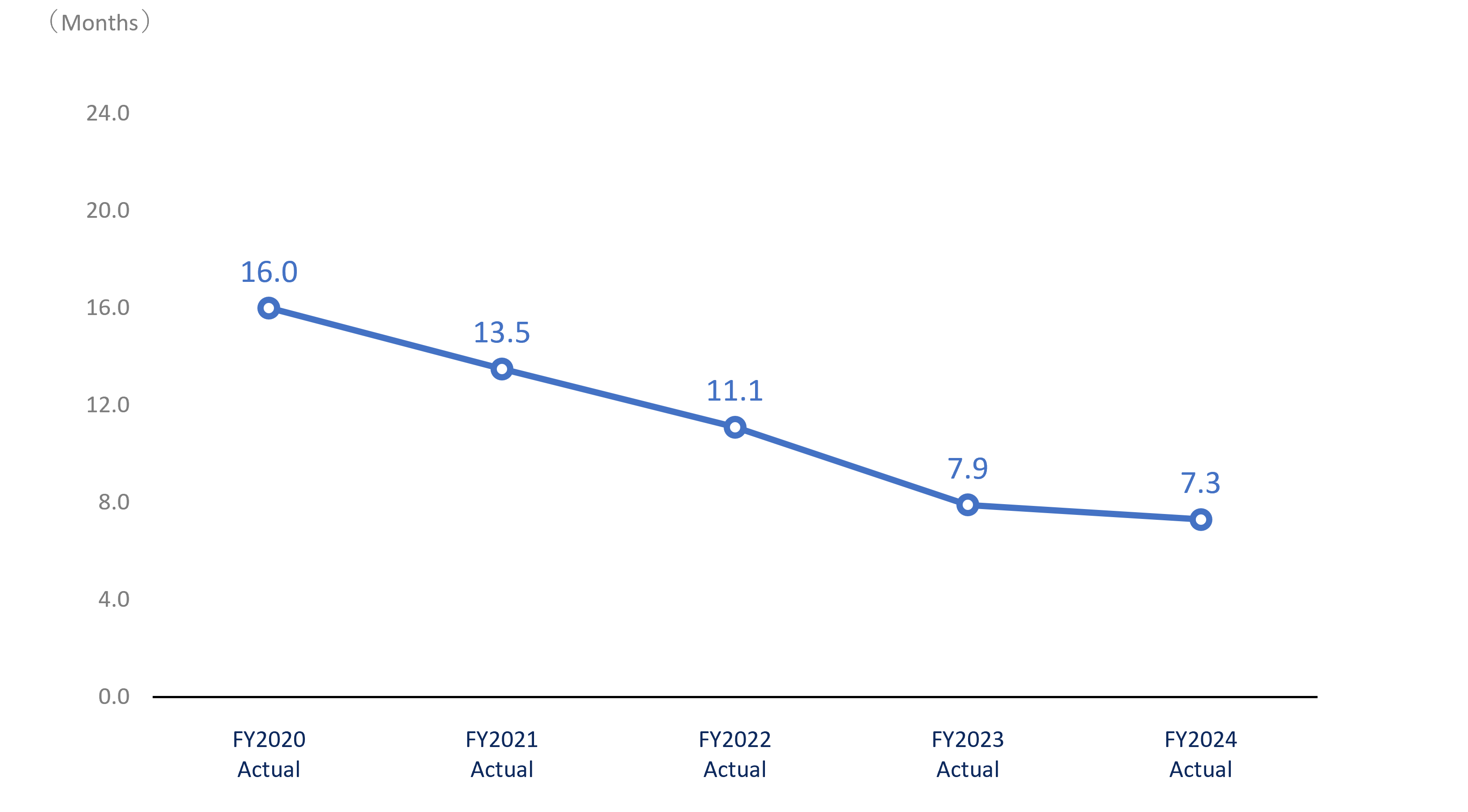

Cash & marketable securities to monthly sales ratio Months |

16.0 | 13.5 | 11.1 | 7.9 | 7.3 |

- ROE = Profit attributable to owners of parent / Average net assets

- ROA = Ordinary profit / Average total assets

- Total payout ratio = (Total annual dividend + Total amount of repurchase costs) / Profit attributable to owners of parent

- Cash & marketable securities to monthly sales ratio = (Cash + Money held in trust + marketable securities + Investment securities) / (Net sales / 12 months)

ROE・ROA

Total payout ratio

Cash & marketable securities to monthly sales ratio